The team is hard at work getting our product into shape, and we are pleased to share the latest developments.

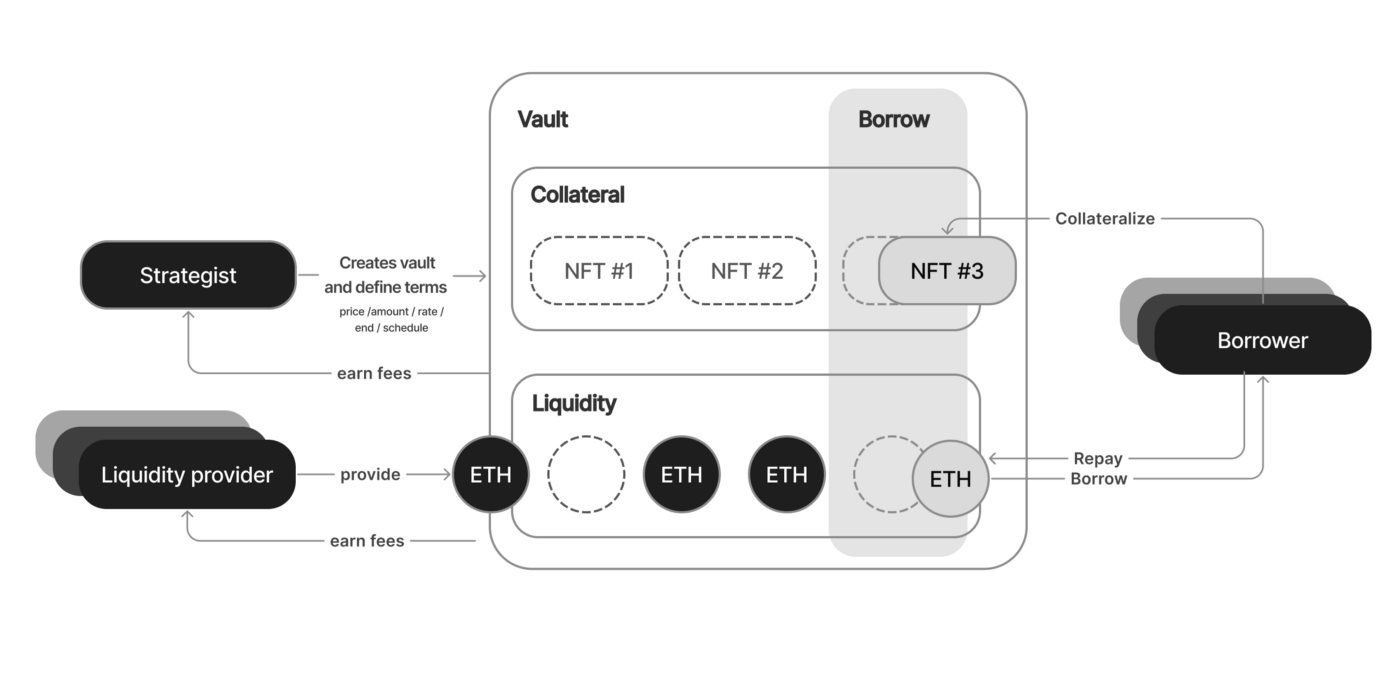

At launch, we aim to provide instant liquidity for the top NFT collections with the easiest-to-use NFT lending process in the market, powered by our three-actor model. Let’s explore who the actors are and what they do.

Current NFT lending protocols use a bidding process where borrowers ask for terms, and liquidity providers can accept these terms. Today, we aim to demonstrate why Astaria’s three-actor model will be the easiest and most efficient platform to use. In future newsletters, we will explore the pros and cons of each design.

Borrowers and Liquidity Providers

The borrower has the asset and wants to access liquidity on their NFT — the first actor. The liquidity provider has capital and would like to earn a yield on their funds — the second actor. The liquidity provider will add funds to a pool, and the borrower will borrow against their asset from the pool. So far, standard DeFi mechanics for ERC-20s.

The Strategist

The challenge with non-fungibles is that they are non-fungible, and not every asset is treated the same from collection to collection or even within them. Therefore, writing acceptable loan terms for an asset is an art as much as a science. This is where we introduce our third actor, the strategist.

To be precise, there are segregated roles between liquidity providers and strategists, a separation between intellect and capital. The strategist writes loan terms for any piece or collection. The terms are based on their models and assumptions. Once a strategist has created a set of terms, the liquidity provider can enter a pool based on the given strategy.

Strategists will naturally try and outcompete other strategists for terms that are both attractive to borrowers and lucrative enough for LPs. Walking this tight rope while managing the risk is a fundamental part of what it takes to be a strategist.

Note that the role of a strategist in this system is to provide a term sheet for any number of NFT(s) and not a valuation. This distinction is necessary to understand why NFT lending differs from fungible lending. Each piece is unique, and the owner will most likely not want to lose their prized NFT — especially when the piece’s value differs from person to person. There is no “correct” valuation, and prices fluctuate.

How we are different

Due to variable prices, we also had to design a term system that was not the standard floor pricing or Oracle-based approach. Instead, the terms written by the strategist are the terms that the protocol will use for liquidations instead of price. If you default on the terms (miss a payment or fail to pay down all debt at maturity), you risk losing your piece. But don’t worry; even if you fail to meet your obligations, you can buy back your NFT up until the last moment in an auction.

The key differentiator is that terms are based on a proxy of valuation — not the valuation itself. Making the liquidation process less price sensitive or prone to floor price manipulation. The system is also optimized for terms based on a more meaningful set of values rather than simple data points.

Providing liquidity to the system will be as simple as any epoch-driven vault. LPs can signal their need to exit the vault and will be able to in the next epoch, provided there is enough reserve. Since the strategist ensures the terms are as up-to-date as possible, LPs can set and forget liquidity.

What’s Next

The team has set an initial launch date internally. The exact date will be shared closer to that time, with more updates and features in future newsletters.

If you think you are up to writing loan terms and have what it takes to be a strategist, reach out to us by filling in this form.

At launch, liquidity providers will be able to provide funds strategists from some of the most reputable appraisers.

Community Alpha

We believe that web3 platforms live by their community. Be sure to keep an eye out for what we have planned for our community after the launch. Until then, we keep BUIDLing.

Follow us on Medium and Twitter for the latest details, and subscribe to our website mailing list for the latest updates.